Project finance for renewable energies - an overview

Guest article

Lars Quandel, managing partner at Dauerkraft Finance GmbH

How does project finance for renewable energies work? This is not a simple question - and therefore there is no simple answer. Many things need to be planned and clarified before a solar or wind farm can actually produce electricity - not least financial issues. There are standard financing procedures as well as individual scope for design. Lars Quandel, managing partner of the independent advisory firm Dauerkraft Finance, sheds light on the subject. In this article, he explains how negotiations between banks and project developers work.

The complex world of energy transformation

It is clear that the energy transition in Germany has always been a mammoth task - just think, for example, of the sheer dimensions of the technology and materials that have to be installed in fields, on roofs, on coasts and in other places. The goal: to turn our previously coal-dominated republic into a climate-friendly country full of green energy that is less dependent on fossil fuels. However, even on a small scale, it is clear how highly complex the energy transition is - if only in terms of project finance for renewable energies.

As a non-specialist, you can only guess how wind turbines or large solar parks ultimately make it to the site. But how do the economic processes behind them work? After all, the energy transition is of course not just a technical process. Renewable energy projects usually face the challenge of finding a financing partner for their project. Lars Quandel knows more about this - he supports us at ENGIE Deutschland as an external expert at the Wind Energy Days, for example.

Project finance: How renewable energies become a reality

Lars Quandel: From a lender's point of view, financing is always about the revenues with which a loan can be serviced and repaid on an ongoing basis. There are basically two procedures for bank financing of renewable energies:

- Non-recourse project finance: This type of financing only takes into account the project to be financed and its cash flow and has no recourse to the investor in the project.

- Recourse finance: In addition to the project and its cash flow, this variant focuses on other aspects, in particular the creditworthiness of the investor.

This article focuses on the predominant structure in the market, namely the first of the two types of process.

Prerequisites for non-recourse finance

Non-recourse project finance for renewable energies is subject to a number of requirements. These determine whether a project is even eligible for a lender such as a bank.

- Proven technology: The renewable energy project should essentially use proven technology. This means that the main components have already been successfully installed in other projects and have demonstrated stable performance. This ensures the quality of the technology and its longevity. This is important for a bank, because: It will only provide funding if the project can be operated for at least as long as the financing is intended to run.

- Experienced project participants: As in the point mentioned above about the technology installed and its suppliers, reliable experience is also an extremely important criterion for lenders in other areas, such as the service partner for the system for example.

- Cash flow of the project: This is sufficient in terms of amount and timing to service the debt for each year. The revenues are only used for the operation of the project. For this reason, a renewable energy project is usually set up as a single-purpose company: This has no other fields of activity than to build and operate the respective energy generation plant. The project company concludes a contract with each contracting party relevant to the construction or operation: the individual project contracts. The project company itself is the borrower of the project financing for renewable energies.

The project parties

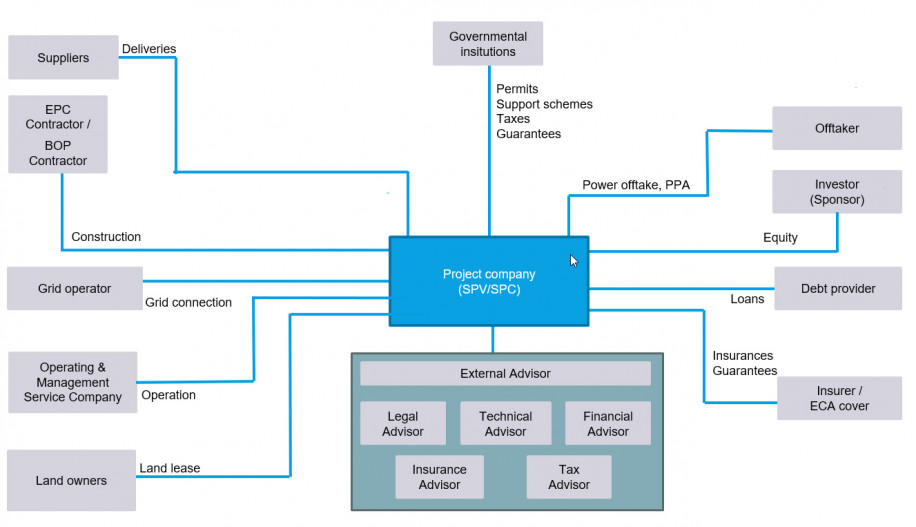

The following diagram shows the main parties involved in project implementation and project finance for renewable energies. It also demonstrates how complex project structures are in today's energy industry.

Project stakeholders and project structure:

Important parameters for project finance

Once the project has been planned, developed and approved, it is ready to start construction. At this point, project developers usually ask banks for project financing. Normally a bank participates in the financing already during the construction phase. It makes the disbursements according to the progress of construction - similar to construction finance for a new real estate building. If one or more banks are interested, the exact financing conditions are negotiated between the parties involved. These include in particular

- Loan volume

- Interest rate

- Structuring fee

- Tenor of the loan

- Repayment structure

- Collateral

- Financial ratios (in particular debt service coverage ratio)

- Termination clauses

- Conditions precedent for draw down

Each of these parameters also influences the attractiveness of the loan. For example: the longer the tenor of a loan, the more debt volume the project can raise. This is due to the cash flow already mentioned, which is collected by the project in the individual years. Current operating costs and taxes are deducted from these proceeds. The remaining free cash flow is available to service the debt capital - i.e. to repay the loan plus interest. Please find the following simplified assumption: 500,000 euros of free cash flow is available each year. Then, for example, more debt capital can be serviced over 20 years with a total of 10,000,000 euros (20 x 500,000 euros) than over 12 years, in which only 6,000,000 euros of free cash flow would be available. The debt service coverage ratio is calculated annually from the free cash flow and the debt service.

Formula for calculating the debt service coverage ratio |

|

Proceeds |

Analysis by the bank

The negotiated parameters are included in the loan agreement and the associated collateral agreements. In addition, the wording of the loan agreement itself is negotiated. At the same time, the bank carries out its own review of the project to be financed. It does this partly itself, but also commissions external experts, for example for technical issues. To do this, the project company must submit all available documents to the bank, which is usually done via a virtual data room. In the case of renewable energy projects, this can easily result in a high two or even three-digit number of documents.

Conditions precedent for the disbursement of project finance for renewable energies

After the successful review and approval by the bank, the parties sign the loan agreement and the collateral agreements. These agreements form the contractual basis for the loan. The project company as borrower must then fulfill the previously negotiated conditions precedent. Only then does the bank pay out the loan. For the most part, formal proof must be provided, such as the most recent annual financial statements, the opening of an account or the fulfillment of the so-called Know Your Customer (KYC) conditions. Depending on the status of the project, other documents and evidence are also crucial. Examples include signed service and maintenance contracts or the securing of land rights.

The disbursement of the loan

As soon as all conditions precedent have been met, the project company, as the borrower, prepares the draw down notice. It submits this to the bank for disbursement together with the corresponding proof of invoices. The bank then transfers the requested loan funds to the project company's account and the ongoing cooperation between the project and the bank begins.

Project finance for renewable energies in Germany usually runs for about 20 years plus the construction period. Of course, the project company must ensure the credit terms and debt service capability during this entire financing period.

Our Expert